Startup School Transcript

October 16 2010

Ron Conway - Partner, SV Angel

Link to video: http://www.justin.tv/startupschool/b/272178470

Startup School Transcript

October 16 2010

Ron Conway - Partner, SV Angel

Link to video: http://www.justin.tv/startupschool/b/272178470

Ron Conway: The timer is working. I have a hard job right now, because I have to keep you awake after consuming pizza. But if I fail, I have a backup plan, my good friend MC Hammer is here, and if I see enough people dozing off, Hammer is going to come up and dance to get the adrenalin going. (( )) OK. It’s not lost on me that the future of innovation is in the minds of the people sitting in this room.

And I want to get an understanding on who I’m speaking to, so I want to do a quick survey. [sound missing] Wow! OK, now we’re going to see who the minority is. Raise your hand if you haven’t started a company, but you’re thinking about starting a company. Wow, that’s almost everyone else. Who is here just trying to learn about, should I ever think about starting a company? Wow, OK, that’s awesome.

OK, I have [sound missing] what to talk about today and repeatedly, as late as last night, because I was over-analyzing what to talk about, and Paul was as patient as he could be, but he said, Ron, will you just tell the story of the day you met Google, Facebook and Twitter, and that will be interesting enough. So, I was over-thinking it, but that’s what I’m going to do, is talk about those companies that I’ve had the honor of working with. These are companies that are run and founded by the most well-known entrepreneurs in the industry, and I’m just going to use them as examples in some of the vignettes that I’m going to talk about. And, hopefully, some of the lessons that you pick up will help you on your road to entrepreneurship. The one thing that I want you to keep in mind is that I am talk-, is that when I’m talking is that anyone of you could be the Larry, the Sergey, the Shawn Fanning, the Mark Zuckerberg. Tho-, all of you have the same characteristics that they had when they started their companies. So, just remember that they started just like everyone in this room.

OK, now I’m going to tell a little bit about myself, just to get you guys gravitated. [laughter] I am not that. I am the real Ron Conway. Or, as Paul refers to me, RonCo.

OK, now I’m going to tell a little bit about myself, just to get you guys gravitated. [laughter] I am not that. I am the real Ron Conway. Or, as Paul refers to me, RonCo.

So, I want to get the point across that I was a co-founder myself, I co-founded three companies. I’m going to focus on one company right now, and that’s Altos Computer, that’s the company that I helped co-found in 1979. It was a micro-computer company, and in its day, very disruptive technology.

So, I want to get the point across that I was a co-founder myself, I co-founded three companies. I’m going to focus on one company right now, and that’s Altos Computer, that’s the company that I helped co-found in 1979. It was a micro-computer company, and in its day, very disruptive technology.

It was a very typical startup, the day we started the company we sat on the floor because there was only one chair, we were very, very frugal. For the first two years I sat next to the copy machine, on a little table - we were really, really frugal. We all worked hard and played hard and that kind of became the culture of Altos: work hard, produce results, play hard.

We might have been one of the first companies that invented TGI Friday, the interesting thing is we did it everyday. And the funny thing is our CFO at 5 o’clock would wheel a cart with wine and beer to every desk, we would all drink and fraternize for an hour, and then everyone went back to work. And that, that set the culture of the company.

Being a typical founder, I worked my tail off, I was the head of sales, I traveled 80% of the time getting orders and building the company. We even built our own trade show booths, because we couldn’t afford the union labor, and we did this about four trade shows in a row.

And then come into Chicago, which is a huge union town, we came to the show the first day after we set up our own booth, and they had literally blown up the computers. So, we were busy selling computers in the back of one of the co-founder’s VW, a very beat up VW. I drove a GrandPrix, it had a very distinctive trait, the sunroof leaked. One night, after going to meetings, I was in the car, in this leaky car, pouring rain, rain falling all over us, literally, and the co-founder of company, Dave Jackson, said “Someday we’re going to take this company public, and we’re going to drive nice cars.” Well, sure enough, we did go public, we both bought new cars, but even more satisfying, we had a guy on the factory floor, who was a co-founder, who built the computers, and it was a big deal when we built five a month, but ultimately, we ended up building 1000-2000 computers/month. His life long dream was to own a Porsche, and he would never ever buy a Porsche for himself. So when we went public, we bought him a Porsche, drove it into the back of the factory and had quite a party.

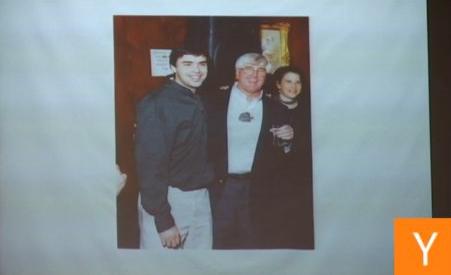

But that was then, and this is now. I want to describe a little bit about what the investing environment was 30 years ago. Understand, 30 years ago there were no angels. There weren’t any super angels either, whatever those are. You literally had to bootstrap your company and have some level of profitability if you were going to get VC funded. So, the only funding was on St. Hill Road. We were lucky enough to get funded by Sequoia Capital. We had Don Valentine on our board of directors, who, at the time, was the premiere figure head in technology in Silicon Valley. He was one of the founders of National Semiconductor, which is the first place I worked. And here is a picture that I took with Don just a few months ago. That’s Don Valentine on the left, myself, Mark Pincus, now in ‘79 he probably wasn’t born, and then you have Carol Bartz, now the CEO of Yahoo!, who at the time, when we started Altos, was literally a Sales Rep. at Sun Micro-. Once again, anybody can do it.

But that was then, and this is now. I want to describe a little bit about what the investing environment was 30 years ago. Understand, 30 years ago there were no angels. There weren’t any super angels either, whatever those are. You literally had to bootstrap your company and have some level of profitability if you were going to get VC funded. So, the only funding was on St. Hill Road. We were lucky enough to get funded by Sequoia Capital. We had Don Valentine on our board of directors, who, at the time, was the premiere figure head in technology in Silicon Valley. He was one of the founders of National Semiconductor, which is the first place I worked. And here is a picture that I took with Don just a few months ago. That’s Don Valentine on the left, myself, Mark Pincus, now in ‘79 he probably wasn’t born, and then you have Carol Bartz, now the CEO of Yahoo!, who at the time, when we started Altos, was literally a Sales Rep. at Sun Micro-. Once again, anybody can do it.

So, we all have different definitions of success. For me, at Altos, getting out of a flooded car was one, but more importantly, being able to build and define the culture of the company, and achieve sales of over $100 million a year, and in the early 90’s we were the fastest growing company in America - that was more satisfying than getting rich. Everyone in this room should understand, you can do it too.

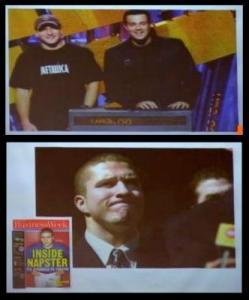

So, let’s talk about other entrepreneurs. I want you to picture this in your imagination. At the very top of the Internet bubble, in 1999, I had a party at my home with 600 guests, tons of entrepreneurs like yourselves, and then venture capitalists. We had Warren Buffett as a guest speaker, and we had Dana Carvey as an auctioneer, we did a charity auction where we raised $2.2 million in a half hour. And at this event was Mark (( )), and all the top VCs, you name them. But also at this party were Larry and Sergey, Google was one year old at the time, and this guy called Shawn Fanning, the founder of Napster. So guess who you think people gravitated to at this party. Fanning had a crowd around him the whole time, Napster had 40 million users in record time. I always was a big believer in Google, so at this party I said I’m going to go talk to the two wallflowers over there, Larry and Sergey. And I went over to them and said “What’s up, guys?” And they go “Hey, we’re doing great, we’re going to build a big company too, [laughter] but we will never be famous like Shawn Fanning.” And I said “I think you’re going to be very wrong someday.” And I think history has proven that.

So, let’s talk about other entrepreneurs. I want you to picture this in your imagination. At the very top of the Internet bubble, in 1999, I had a party at my home with 600 guests, tons of entrepreneurs like yourselves, and then venture capitalists. We had Warren Buffett as a guest speaker, and we had Dana Carvey as an auctioneer, we did a charity auction where we raised $2.2 million in a half hour. And at this event was Mark (( )), and all the top VCs, you name them. But also at this party were Larry and Sergey, Google was one year old at the time, and this guy called Shawn Fanning, the founder of Napster. So guess who you think people gravitated to at this party. Fanning had a crowd around him the whole time, Napster had 40 million users in record time. I always was a big believer in Google, so at this party I said I’m going to go talk to the two wallflowers over there, Larry and Sergey. And I went over to them and said “What’s up, guys?” And they go “Hey, we’re doing great, we’re going to build a big company too, [laughter] but we will never be famous like Shawn Fanning.” And I said “I think you’re going to be very wrong someday.” And I think history has proven that.

Shawn Fanning built a brand name immediately with Napster, but Napster didn’t survive, and Shawn never got financial wealth from Napster as well. But he did build an international brand name for himself, and that gave him the credibility to start his second, third, fourth, and now his fifth company. So, Shawn Fanning took a failure at Napster, but persevered right through it, started Snocap and has done several other companies since then. And, boy, was he a smart guy!

Shawn Fanning built a brand name immediately with Napster, but Napster didn’t survive, and Shawn never got financial wealth from Napster as well. But he did build an international brand name for himself, and that gave him the credibility to start his second, third, fourth, and now his fifth company. So, Shawn Fanning took a failure at Napster, but persevered right through it, started Snocap and has done several other companies since then. And, boy, was he a smart guy!

At 19 years old, you know, when I met him, he was perceptive as ever. In one of the days that I thought would be the most dramatic of his 19 year old life, when Napster was taken to court at the 9th Circuit, on Golden Gate Ave. in San Francisco, we lost the first court ruling, and there were literally 50 members of the media, Golden Gate Ave. was closed off with media trucks, and they had this press conference. And before they started the press conference, and of course, with the ego of lawyers, Shawn was not even asked to speak at the press conference, I snuck up in the back of Shawn and said “Are you doing alright?” He said “Yeah, I’m doing fine.” He goes “Look at my suit.” I go “What’s so special about the suit?” “Well, for one, I’ve never worn one, they called me last night and told me I had to wear one, so I borrowed one.” And then he says “Look down.” And, literally, the pant legs were dragging behind him. But he was smart enough to know, when Napster got involved with the courts, that it was probably all over for Napster. He was already moving ahead in his mind to his next company. There is somebody who is perceptive and thinks about the future. And about a month later he called me up and said “Hey, let’s have lunch, and let’s have lunch fast.” So, I run up, we met at this restaurant at the airport and he says “I’m leaving Napster.” This was when Napster had 60 million users. And he says “I want to start this company called Snocap.” - the company that became Snocap - “because it will solve the problems that Napster created”. And I said “Shawn, let’s keep that a secret for a while because Bertelsmann just invested $75 million in Napster and I think they think that you’re staying.” So he did, but sure enough he was right, Napster went out of business, and we co-founded Snocap together. He had the foresight to think ahead.

Now, let’s talk about the start of Google. I’d like to share how I met Larry and Sergey. It was when the company was called BackRub, they had not given it the name Google yet. I was at a holiday party at Vivek Ranadive’s house in Atherton, and met one of our investors in the angel funds at the time, David Cheriton, who worked very closely with Andy Bechtolsheim, who spoke earlier, and I said “David, you’re an investor in the fund, show me a good deal.” And he said “Well, this is BackRub.” And he described page rank and that the value of the product was relevance. I had just been involved in the IPO of Ask Jeeves, and the word page rank and relevance resonated and I bird dogged David for a couple of months and, finally, he introduced me to Larry and Sergey. They were very picky and discerning, this is when they were racing the VC round, and they said “Hey, Ron, if you help us get Sequoia to invest, because we want to have an OEM partnership with Yahoo!, then we’ll let you invest.” Thank God nobody else knew the Sequoia guys, Sequoia became an investor with KP in Google, and off we went.

Now, let’s talk about the start of Google. I’d like to share how I met Larry and Sergey. It was when the company was called BackRub, they had not given it the name Google yet. I was at a holiday party at Vivek Ranadive’s house in Atherton, and met one of our investors in the angel funds at the time, David Cheriton, who worked very closely with Andy Bechtolsheim, who spoke earlier, and I said “David, you’re an investor in the fund, show me a good deal.” And he said “Well, this is BackRub.” And he described page rank and that the value of the product was relevance. I had just been involved in the IPO of Ask Jeeves, and the word page rank and relevance resonated and I bird dogged David for a couple of months and, finally, he introduced me to Larry and Sergey. They were very picky and discerning, this is when they were racing the VC round, and they said “Hey, Ron, if you help us get Sequoia to invest, because we want to have an OEM partnership with Yahoo!, then we’ll let you invest.” Thank God nobody else knew the Sequoia guys, Sequoia became an investor with KP in Google, and off we went.

Everyone critiques valuations, the valuation of that round was $75 million ((pre)), and all of us felt lucky to get in it. All this procrastination and discussion about valuations is completely crazy. I agree with Paul, companies are binary, they’re either big wins or they don’t win, let the marked decide the valuation. And the people who invested $75 million in Google made about $400 for every dollar they put in, so I don’t think anybody is complaining. The other thing that really interested me is that Larry and Sergey came to every one of the monthly SEO summits that we had back in 1999, in 2000. Our fund would sponsor these SEO summits. Larry and Sergey would get there first and be the last to leave. They were just like everybody in this room, they couldn’t wait to interact with other entrepreneurs and learn about business partnerships, which is something they didn’t know about, that we helped them with. Because they were inquisitive, they learned quick, and decided that their values would be providing a service that made users happy. And if users are happy, you build a good brand name, and after you build a good brand name, then you can monetize. That’s the recipe for success in the 1990’s and 2000.

When I was trying to get our allocation in Google, and once again, because of Ask Jeeves’ success, I knew Google was on to something, the guy running operations at the time, an unsung hero, he was 21 years old back in 1999, and he administered the allocations for the people who got to invest in Google. I made it my business to get to know him and become his friend.

When I was trying to get our allocation in Google, and once again, because of Ask Jeeves’ success, I knew Google was on to something, the guy running operations at the time, an unsung hero, he was 21 years old back in 1999, and he administered the allocations for the people who got to invest in Google. I made it my business to get to know him and become his friend.

His name is Salar Kamangar. So I went and sat at Salar’s desk, there were no offices, and I said, you know, “How did you get here?” I mean, Salar still looks like he’s 18. And he said “Well, I dropped out of Stanford Med School”. And I said “My God, what are your parents saying?” He goes “My parents want to kill me.” And when I see Salar now, I say “Do your parents still want to kill you?” And we relive that moment when I said “Your parents are probably so pissed at you, but you see the vision of what you’re going to build at Google.”

The first time I met Sheryl Sandberg, which is like four years into Google’s history, and this is an unknown fact, Google thought they were going to run out of money. This is after the Sequoia, KP, and Yahoo! investments. There was a two month window where Google thought they’d run out of money, and Sheryl’s first assignment when she worked at Google was to call me, and try and round up some quick money. The sad thing is ten days later they said “No, AdWords is working.” But guess who thought of an invented AdWords. It was Salar Kamangar, the pre-med student who was, at the time of the start of Google, the low man on the totem pole, but he thought through the business case, and he’s the one that said “Wait a minute, I think I know a way we can monetize this.” This was after the brand was built, and Google was ready, and Salar Kamangar, one of the ((rank in file)) is the one who came up with the idea.

So let’s talk about Facebook for a minute. Has anyone seen the movie? [laughter in the audience] No? I guess the rest of you were starting the companies. [laughter in the audience] So, I think Zuck definitely meets the definition of anyone can do it if they think big. I met Mark Zuckerberg six years ago at the University Cafe in Palo Alto.

So let’s talk about Facebook for a minute. Has anyone seen the movie? [laughter in the audience] No? I guess the rest of you were starting the companies. [laughter in the audience] So, I think Zuck definitely meets the definition of anyone can do it if they think big. I met Mark Zuckerberg six years ago at the University Cafe in Palo Alto.

Sean Parker, the co-founder of Napster, who I worked with at Napster, we were angels in Napster, went on to start Plaxo. I was the original angel in Plaxo, so when Parker went to be the president in Facebook, obviously he called me  and wanted me to help mentor them. And I immediately, after this lunch with Mark, started advising the company on the impending VC rounds, where it was Excel versus the Washington Post competing, and Excel outbid the Washington Post, and the rest is history. But that’s all well chronicled in the book The Facebook Effect, but when I look back and see that the misperception that this movie The Social Network is giving Facebook, I think it is sickening because I was there for a lot of it and what’s in the movie is not reality.

and wanted me to help mentor them. And I immediately, after this lunch with Mark, started advising the company on the impending VC rounds, where it was Excel versus the Washington Post competing, and Excel outbid the Washington Post, and the rest is history. But that’s all well chronicled in the book The Facebook Effect, but when I look back and see that the misperception that this movie The Social Network is giving Facebook, I think it is sickening because I was there for a lot of it and what’s in the movie is not reality.

The Mark Zuckerberg that I met six years ago was not partying all the time and he  was not sitting in depositions five days a week, arguing with lawyers. He was working his tail off like any good entrepreneur. When I met him for the first time at the University Cafe, he completely had the vision for what Facebook is today, to make the world a more open and connected place, and build community. The vision that he had has been consistent from the beginning. That’s not in the movie. At the time, social networking, six years ago, was very, very new to me. I had lots of gray hair then too, and I said to Mark “How are you going to measure success with this thing called social networking?” And he looked me in the eye and said “Because someday I’m going to have 300 million users using this product.

was not sitting in depositions five days a week, arguing with lawyers. He was working his tail off like any good entrepreneur. When I met him for the first time at the University Cafe, he completely had the vision for what Facebook is today, to make the world a more open and connected place, and build community. The vision that he had has been consistent from the beginning. That’s not in the movie. At the time, social networking, six years ago, was very, very new to me. I had lots of gray hair then too, and I said to Mark “How are you going to measure success with this thing called social networking?” And he looked me in the eye and said “Because someday I’m going to have 300 million users using this product.

He was wrong! It’s 500 million, headed to a billion. That says he’s humble. [laughter in the audience, applause] No wonder he didn’t want to sell Facebook to Yahoo! four years ago for a billion dollars. He had the vision. He was smart enough though, a year after that, to take a $15 million investment from Microsoft at a $280 million valuation, which allowed him to keep scaling his company. At the time Microsoft looked like they were crazy. Today, at $15 billion valuation for Facebook, they look like complete geniuses. It would be nice if The Social Network movie characterized the accomplishments of Zuckerberg and Sean Parker. I have one example. This is six years ago, they’re in an office above a Mexican restaurant in Palo Alto, seven or eight people, and Sean Parker tells me “We are going to be a brand as big as Apple.” Just like Andy Bechtolsheim, Parker really thought Apple had the best brand six years ago. And he said so “We’re going to do our first big sale to Apple, so people identify the Facebook brand with the Apple brand.” And I said “Wow, I want to help you do that, but that’s a lofty goal.” 60 days later Apple did a deal with Facebook. It was their first major contract. That is an example of thinking big and executing. That is not in the movie.

He was wrong! It’s 500 million, headed to a billion. That says he’s humble. [laughter in the audience, applause] No wonder he didn’t want to sell Facebook to Yahoo! four years ago for a billion dollars. He had the vision. He was smart enough though, a year after that, to take a $15 million investment from Microsoft at a $280 million valuation, which allowed him to keep scaling his company. At the time Microsoft looked like they were crazy. Today, at $15 billion valuation for Facebook, they look like complete geniuses. It would be nice if The Social Network movie characterized the accomplishments of Zuckerberg and Sean Parker. I have one example. This is six years ago, they’re in an office above a Mexican restaurant in Palo Alto, seven or eight people, and Sean Parker tells me “We are going to be a brand as big as Apple.” Just like Andy Bechtolsheim, Parker really thought Apple had the best brand six years ago. And he said so “We’re going to do our first big sale to Apple, so people identify the Facebook brand with the Apple brand.” And I said “Wow, I want to help you do that, but that’s a lofty goal.” 60 days later Apple did a deal with Facebook. It was their first major contract. That is an example of thinking big and executing. That is not in the movie.

So, let’s ta-, now you tell what I think of the movie. Let’s talk about Twitter for a second. Twitter, another company that is thinking big. I met Evan Williams, Jack Dorsey, and Biz Stone when they had an incubator called Obvious Corp., and Twitter grew out of that, and they just… And that’s Twitter is only a four year old company, and they have just announced and acknowledged that some day they will have a billion users. Quite a propos, because a year ago they raised money at a billion dollar valuation, and a buck per user sounds cheap.

So, entrepreneurs come in all shapes and sizes. And I need to get going. You have outgoing entrepreneurs, you have shy and reserved entrepreneurs, but the fact of the matter is, once an entrepreneur, always an entrepreneur. And you don’t need a business plan and you don’t have to have graduated and gotten an MBA degree. All you need is a great idea, and realize that anything is possible, and you can accomplish that.

So, entrepreneurs come in all shapes and sizes. And I need to get going. You have outgoing entrepreneurs, you have shy and reserved entrepreneurs, but the fact of the matter is, once an entrepreneur, always an entrepreneur. And you don’t need a business plan and you don’t have to have graduated and gotten an MBA degree. All you need is a great idea, and realize that anything is possible, and you can accomplish that.

In closing, entrepreneurs are the ones who build the companies, and should be the sole subject of bloggers and the press, not investors. You’re the ones that are innovating, the investors are the ones lucky enough to be able to be part of it. Never forget it’s your company, it’s not anyone else’s company, it’s the founder’s company. Anyone can do it, once an entrepreneur, always an entrepreneur! I’d like to stop for questions. [applause] And we’re going to talk fast so Jessica doesn’t get mad. And I’d like to thank Kevin Carter who kept the slides in sync with my chatter. [applause] And found all the content. Question.

In closing, entrepreneurs are the ones who build the companies, and should be the sole subject of bloggers and the press, not investors. You’re the ones that are innovating, the investors are the ones lucky enough to be able to be part of it. Never forget it’s your company, it’s not anyone else’s company, it’s the founder’s company. Anyone can do it, once an entrepreneur, always an entrepreneur! I’d like to stop for questions. [applause] And we’re going to talk fast so Jessica doesn’t get mad. And I’d like to thank Kevin Carter who kept the slides in sync with my chatter. [applause] And found all the content. Question.

Audience: (( ))

Ron Conway: Do founders have more control now, as they get a little more leverage to define who’s on, to control the board of directors.

Audience: (( ))

Ron Conway: Yeah. So, Mark Zuckerberg controls a majority of the board seats at Facebook. That is an iso-, I believe, it’s an isolated incident, it comes out of Sean Parker having some experiences he didn’t like, and so, he said to Zuck “Never give up control of the board.” I personally believe that entrepreneurs should focus on building a great company. The board of directors is a by-product, and the fact of the matter is, you’re not going to get in the beef with the board of directors, unless things are going terribly wrong.

Audience: (( ))

Ron Conway: Well, a board of directors better listen to the founder. Any board of directors who doesn’t listen to the founder when they get an M&A offer is stupid and irresponsible, because it’s not their company, it’s the founder’s company. [applause] And I believe, all the M&A I’ve seen in the last couple of years, the board of directors totally respected the wishes of the founder. And there are vivid examples lately, Yelp and AdMob, just a hint. Other…

Audience: (( ))

Ron Conway: No, I think one of the, my secret to success is I do not take board seats, I think board seats are a waste of time. I just spent 20 minutes with Dalton Caldwell at ((Treasurer)) Union, and accomplished ten times more than I could going to his last four board meetings. We just get involved at inflexion points and help the entrepreneur when they want help, and then we go away and help the next company. We don’t like to waste time. That’s just our strategy. Ya.

Audience: (( ))

Ron Conway: Wow, the most unexpected thing I’ve learned in the Valley. I think that probably that innovation, the pace of innovation keeps increasing and not decreasing. When we had the mortgage meltdown three years ago, I actually thought the pace of innovation and the number of startups would go down, and it stayed steady, and now it’s higher than ever.

Audience: (( ))

Ron Conway: What we look for when we invest in a startup is mainly the quality and character of the people. So, it’s the people first, the idea and the market size second and third. How about somebody in the back? Way, way in the back.

Audience: (( ))

Ron Conway: Funny enough, Don Valentine says you should judge the market first. I disagree with Don Valentine, even though we’re great friends. I’ve always disagreed with him on that point. I think the entrepreneur comes first, the market second. But who knows who’s right?

Audience: (( ))

Ron Conway: Is it crazy to start a company with one founder? I would have to say yes. It’s all about building a team, and if you’re a founder and you’re going to build a great company, you have to build a great team someday, so why not build it the day you start the company? It’s one of the first hurdles to get over.

Audience: (( ))

Ron Conway: I think casual gaming is completely exploding the space we invest in, I don’t profess to be a genius at it, but I think casual gaming has a long way to go, and it’s going to be a huge market. How about way in the back again?

Audience: (( ))

Ron Conway: Do we make international investments? We do not. We invest in Silicon Valley and New York. And New York’s only for the last couple of years that we opened our eyes to the East Coast.

Audience: (( ))

[laughter]

Ron Conway: Bandwith, bandwith it’s be-, we just don’t have the bandwith to have companies in Europe and the Far East. We have trouble just being in the Internet, in the Internet space, in Silicon Valley and New York. By the way, I usually say this, in 1994 I sold my last company and decided that all I wanted to do was be an angel investor, and that’s an easy decision. The crazy decision was that in 1994 I said “I’m only going to invest in this thing called the Internet” and I’m still doing that, and it’s doing well.

[laughter]

Audience: (( ))

Ron Conway: Is there such a thing as being too young to be an entrepreneur? I would say absolutely not. The youngest we have founded is Zuck, at 19, I met Sean Fanning when he was 18. And how old are you? [laughter] Have you- [laughter, applause] We had a company that didn’t do well, but it was founded by a 17 year old, and I angel invested, and when we signed the docs his mother came, and I said “Oh, this is so sweet that your mother came.” And then my lawyer tapped me on the shoulder and said “He can’t sign for himself, the mother has to be here.” [laughter]

Audience: (( ))

Ron Conway: Give us the business outline. [laughter] OK, way, way in the back. Nobody? How about in the front? Yeah.

Audience: (( ))

Ron Conway: We would prefer entrepreneurs to approach us with a prototype, it’s easier to judge. But we also talked to entrepreneurs just with an idea as well.

Audience: (( ))

Ron Conway: The deal I regret the most in turning down, without a doubt, salesforce.com. What I regret about it is I never ever see Marc Benioff without him reminding me [laughter] that I-. And I probably see Benioff now, because we’re good friends, at least twice a month. And he used to start with it, and now he’s more skillful, we went to dinner a couple of weeks ago, he waited until the middle of the mail meal to start on the pitch. [laughter]

Audience: (( ))

Ron Conway: We absolutely love being the first investor, when it’s us and three founders, that’s when it’s the most exciting.

Audience: (( ))

Ron Conway: We invested in seven out of 35, last class. We love Y Combinator. Oh-oh! OK, this is it.

Audience: (( ))

Ron Conway: I think New York is just like three years behind the entrepreneur friendly infrastructure of Silicon Valley. A couple of years ago, New York wa-, that was so far behind-, you would take a big risk investing there. I think that risk has gone away. Infrastructure and the flywheel of other startups is moving very nicely. Thank you very much!

[applause]

Ron Conway: Wait! Wait! OK. Jessica is going to kill me.

Audience: (( ))

Ron Conway: At the time I was not giving market advice, I was on the sidelines. We’re very involved for the-, we’re very involved until the company has about 200 people, after that, guess what, the VC want to think they’re in charge, and we’re off to, I was off to Twitter when that had happened. But I admire Mark for having the courage of thinking big and saying no. Thank you.

[applause]